Here is the correct version: Here is the sharper image clock calendar alarm clock thingy. Magyar, it was from the sharper image. The whiff got this for me before we were husband and wife, and unfortunately, some stuff had laid on it for some time and it sort of melted into the paint, which is why there are marks in it like that. It's really weird. It's a talking alarm clock. See, it's just talking there. And if I press the button, so that's really the extent of its talking capabilities. Let me see if I get it to stay there. Yeah, sorta. That's really the extent of its talking capabilities. The batteries in it are weak at best. This doesn't get used much. It sits next to the weather station thing machopper, which I had a video on just before this one. You can set an alarm, you can set probably multiple alarms. And one other interesting thing it has is music. It has a number of tunes set. First, yeah, it makes that annoying sound. And oh, it announces the number, so it has 1 through 15, I think. It was on 6. And then it has tempo, tone, volume. And I think this is for the alarm, a cockadoodledoo or a music thing. And as snooze that turns on or off, I don't know. I don't remember how to even use it, but it has interesting music. Let's see if I think Music. It's interesting because it sounds very square-wave like, and I like that because my original computer, which was the IBM PC jr., had a three square wave generator for sound plus a noise channel, otherwise known as Tandy sound if anybody goes back and remembers any of that. This was, I think, this song I'd...

Award-winning PDF software

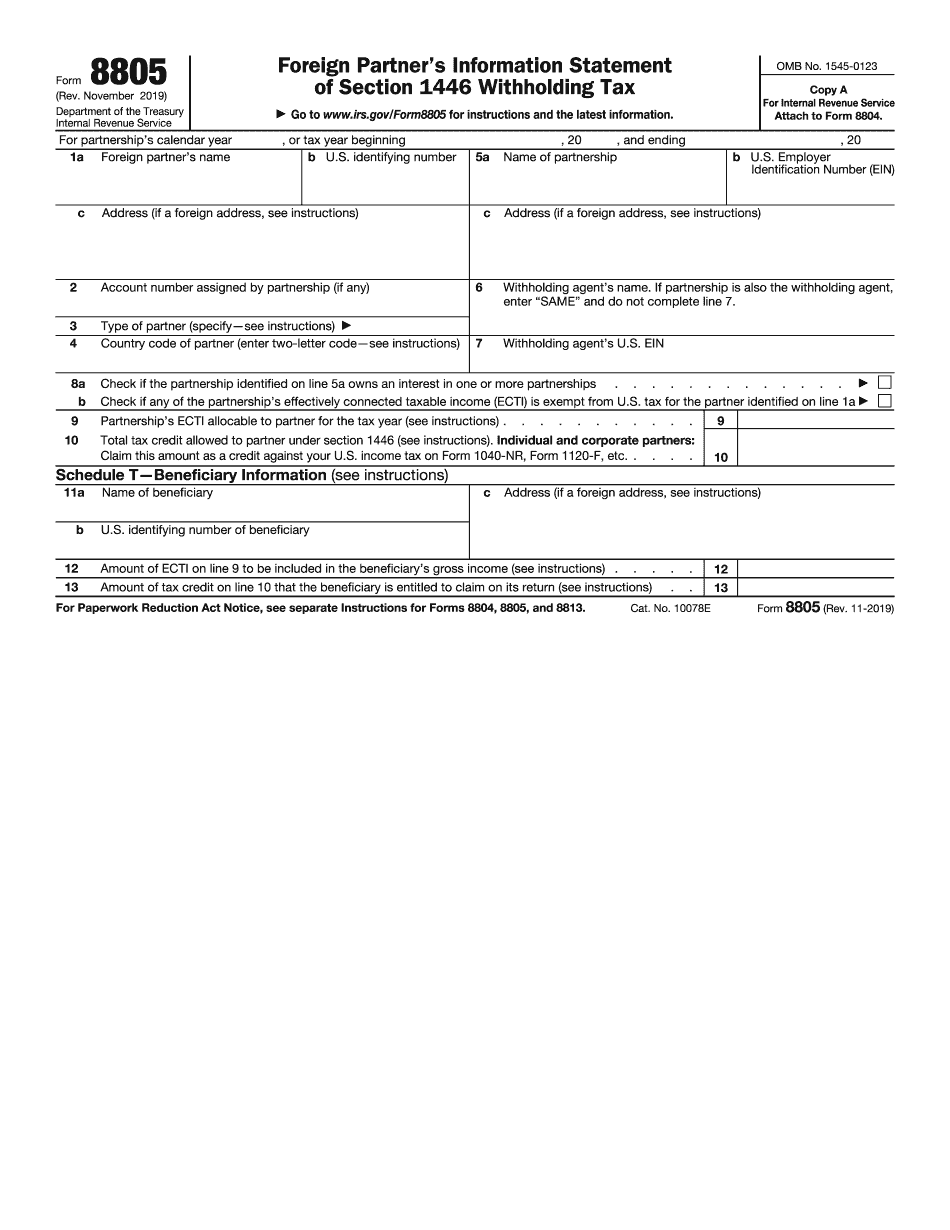

8805 vs 1042 Form: What You Should Know

For example, if a U.S. resident partner files Form 8809, the filing deadline for Form 1043 should not be extended. You must file by the filing deadline in order to avoid late filing penalties. Mar 16, 2025 — The form is no longer required for partners of a U.S. non-profit which reports foreign income on Schedule C. 2021 Instructions for Form 8813: U.S. Partnerships With Foreign Partners — Federal Tax Administration Uses the form for payments to the IRS. Mar 23, 2119 — The IRS has published a letter explaining the new filing requirement when there are multiple foreign income taxpayers. 2021 Instructions for Form 8809 — The partnership and each partner may choose how to claim their share of PCI on their U.S. income tax returns for the taxes required to be withheld in their foreign source income under section 1446. The same form can be used to claim each partner's share of withholding under IRS guidelines. Oct 9, 2025 — Payment and reporting requirements end and the partnership is not permitted to claim any of the additional withholding under section 1446, including the U.S. tax if this was not deducted and withheld as required before the partnership file their U.S. tax returns for the year. It is also not permitted to add any penalty for any additional withholding to the tax already paid to the IRS for the year (federal). In short, payments to foreign partners (and partners of a U.S. non-profit) become a foreign source income for all taxing years. If a partner did not make a U.S. taxable payment in 2025 (tax withholding and gross wages) then he/she may be a foreign source income taxpayer for taxes due in the foreign country the partnership has a resident non-tax resident principal place of business and the partnership has no domestic source income. This is likely because the partnership will not have U.S. source income because it is based either in the foreign country, or abroad. However, this does not apply to payments made after 2009. 2022 Update: Sep 5, 2025 — Effective Jan 4, 2023, a partnership will be subject to the tax for its international earnings from the partnership if any of the partners or U.S. related non-profits are based in the foreign country the partnership has a resident non-tax resident principal residence at the end of 2015.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8805, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8805 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8805 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8805 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8805 vs 1042