Divide this text into sentences and correct mistakes: Excuse me, but could you please move up? Oh, I just saved all your lives, okay? So, what'd I miss? Hello, you worthy, I mean, thoughtful students. For, you know, I am Principal Ultron. Now, let's all sing our National Anthem. Oh, hell it, all hail it! Bump, bump, bump, bump. You're truly inspirational. And now, the choir will sing a lovely song. What, girls? Oh my God, we cloned, yeah, I called cool with only clones. Oh my God, we're clones. Did anyone realize we're clones? Oh my God, coffee, Starbucks, better again, truly inspirational. And now, first row, I'd like to congratulate you for making it to the front row. Because if you didn't make it to the front, yo, you're pretty much, like, sorry. Now, time for the plumbers. Captain America, Iron Man, Hawkeye, Black Widow, Ultron, Joan 262, face James Buchanan Barnes, not the president one though, Jake Lloyd, oh, oh, oh, we're saying real name. Oh, Anakin Skywalker, young virgin, Batman, Batman, the vision, Dalek Supreme, Ahsoka Tano, O'Donnell, Darth Vader, Clara Oswald, Spider-Man, Clone 26, Ant-Man, oh, kinda far, R2D2, rod of the hot Captain Rex, Clone Wars, Anakin Skywalker, Matt Murdock, oh, Daredevil, sorry, Thor from Bob's Fuels University. We'd like to thank parents for coming to our graduation ceremony, and please make sure you grab your children. Don't forget them damn car.

Award-winning PDF software

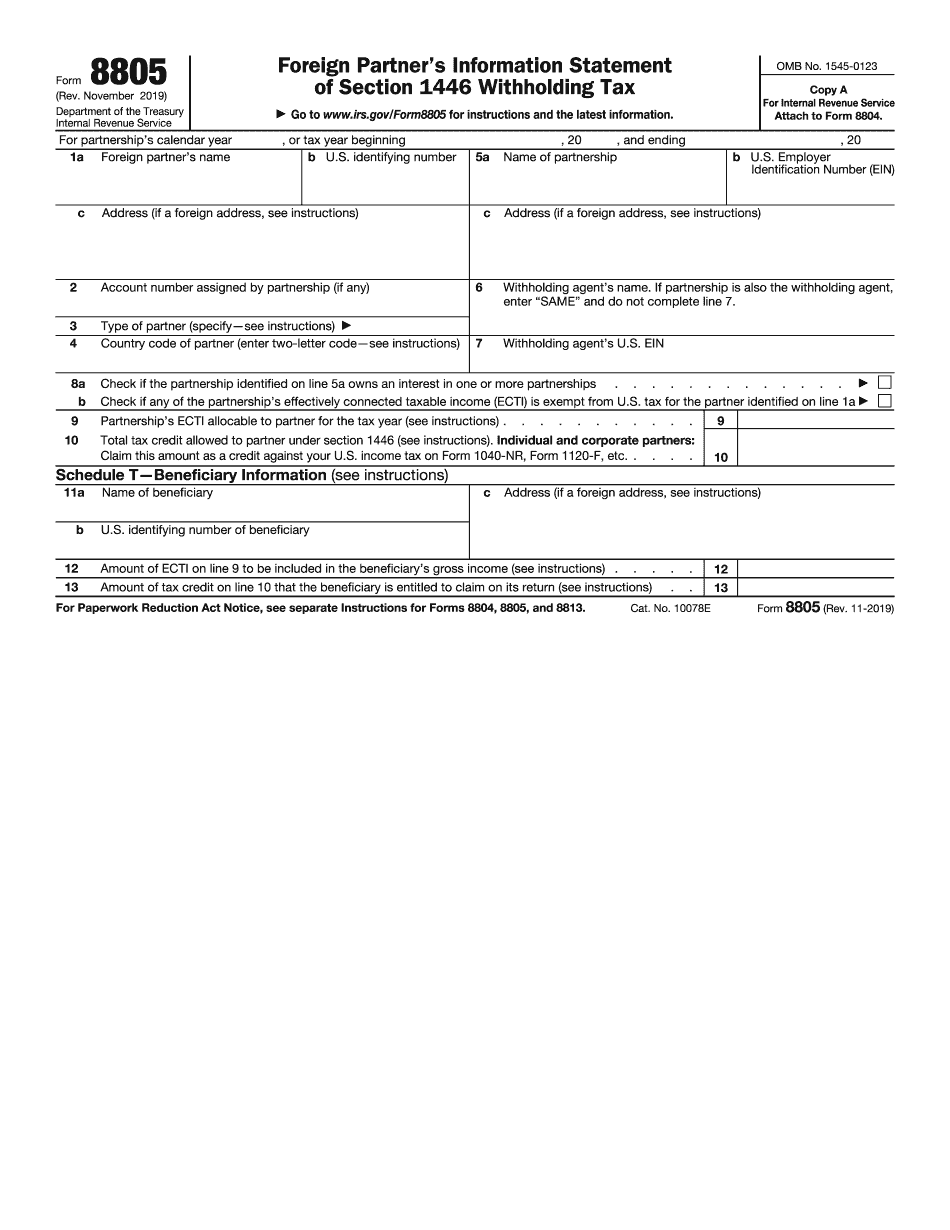

8805 Instructions 2019-2025 Form: What You Should Know

Foreign Tax Credit for Taxes Paid as a Result of Foreign Partnership Income Foreign partners that are U.S. persons and file a joint income tax return with their U.S. tax home (as of the date the foreign partner first became a U.S. partner in a foreign taxable partnership, and with respect to any income received from that partnership by the foreign partner after that date) must reduce (in addition to the standard credit) the U.S. tax imposed by the foreign partnership on any income they report as U.S. partnership income to be eligible for a foreign tax credit on their U.S. foreign tax return, Form 8938, Foreign Income and Investment Tax Payment. 2016 Fiscal Year 2025 Individual Income Tax Requirements for U.S. Partnerships With Tax Haven Partners Explanation of the “Foreign Tax Credit” and other requirements relating to partnerships with tax haven partners. 2016 Form 8802 Foreign Partnership (Partnership Income) Deduction (Partnership tax filing requirements) Foreign Partnerships Generally Required to Use Form 8938. 2016 Form 982 Foreign Partnership (Partnership Income) Deduction (U.S. Tax filing requirements) U. S. Partnership (i.e., partnership for investment) income that is treated or treated for U.S. tax purposes as foreign partnership income of the partnership (for partnership income tax credit purposes) must be included on Schedule K-1 for the partnership. (See the instructions.) 2016 U. S. Partnership Income Deduction Requirements For Foreign Income Tax Credit Purposes (Form 8938) U.S. partnership income received from sources other than a U.S. trade or business is treated for U.S. tax purposes as foreign partnership income of the partnership. (See the instructions.) U.S. income from sources other than a U.S. trade or business is subject to foreign tax credits. 2016 Note: The U.S. Tax Guide for Foreign Partnerships provides comprehensive information on partnership income tax requirements and requirements for partnerships, as well as advice to U.S. tax advisors, on partnership income tax filing, reporting and tax-exempt organization requirements. Expiration of Form 8938. 2016 Form 8938-B U.S. Partnership Income Tax Return, Partnership Income Tax Payment. 2016 Form 8938-B. 2016 Form 8938-B-A.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8805, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8805 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8805 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8805 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8805 Instructions 2019-2025