P>Music Weiss & Associates presents long v-- Rasmussen acknowledging the existence of legal non-taxpayers. You, we, here at Weiss & Associates, have emphasized in our material that the key to understanding the federal income tax, as established by the US Congress in the sixteenth amendment, is based primarily on understanding the impact of jurisdiction. Jurisdiction needs to be defined so that you have a reference point in this topic about the existence of both US taxpayers and those who are legal non-taxpayers of the federal income tax. Please note that by the use of this term legal non-taxpayers, we are not referencing any Nexus to those who are tax cheats, tax evaders, or tax protesters, as the IRS likes to use those expressions. Our statements are only directed toward those who are legal taxpayers and choose not to file and pay their fair share of taxes determined in the Internal Revenue Code. Keep in mind that the IRC is perfectly legal and applicable but only in a single jurisdiction. See how that word jurisdiction keeps popping up? You'll find in Black's Law Dictionary that the term jurisdiction means the legal right by which judges exercise their authority. It also reflects the right and power of a court to adjudicate concerning the subject matter in a given case. The term refers to areas of authority, which is expressed in a geographic context in which a court has power or types of cases it has power to hear. Webster's dictionary defines jurisdiction as the power, right, or authority to interpret and apply the law. An example might be a matter that falls within the court's jurisdiction. It also means the power or right to exercise authority or control. All of this is confined within the limits or territory within which authority may...

Award-winning PDF software

Revenue procedure 92-66 Form: What You Should Know

R.R. Rep. No. 2157 (113th) Jun 29, 2025 — Revenue Procedure 92-66 modifies Rev. Pro. 89-31 (as modified by Revenue Procedure 92-66) to increase the percentage of a partnership's distributive interests that shall be considered nonrefundable. Treasury Regulation section 1.1446-3. Oct 10, 2025 — Section 704(b)(2) of the Internal Revenue Code provides that tax withheld under section 541(a) from a tax-exempt organization's interest in partnership interest at the end of the business year shall be treated as withheld under section 611 of the Internal Revenue Code. Treasury Regulation section 704(b)(2). Dec 28, 2025 — Rev. Pro. 2016-42, 2016-1 C.B. 1111, clarifies that the IRS intends to impose a different withholding tax on foreign sources of income than on United States sources of income. See also: Treasury Regulation section 1.1446-3. Feb 22, 2018 — Treasury Regulation section 1.1446 specifies the procedures and methods in order to remit the applicable percentage to United States Government agencies, and establishes the requirements and penalties for noncompliance. Treasury regulations | Internal Revenue Service Jun 29, 2025 — Revenue Procedure 92-66, and Treasury Regulation section1.1446-3 set forth the time and manner for partnerships to pay the withholding tax due on interest of partners in partnership interests. Treasury Regulations section1.1446-3 (Rev. Pro. 2018-42). Jan 10, 2025 — Treasury Regulation section 1.1446-3 provides for the instructions and notice regarding foreign withholding taxes. Treasury Regulations section 1.1446-3 (Rev. Pro. 6-101). Sep 22, 2025 — This Revenue Procedure clarifies the definition of a foreign partnership and the amount of withholding tax required from foreign sources of income, for purposes of the U.S. Exemption From Tax on Foreign Sources of Income for Tax Years 2025 Through 2013, section 21 (Rev. Pro.

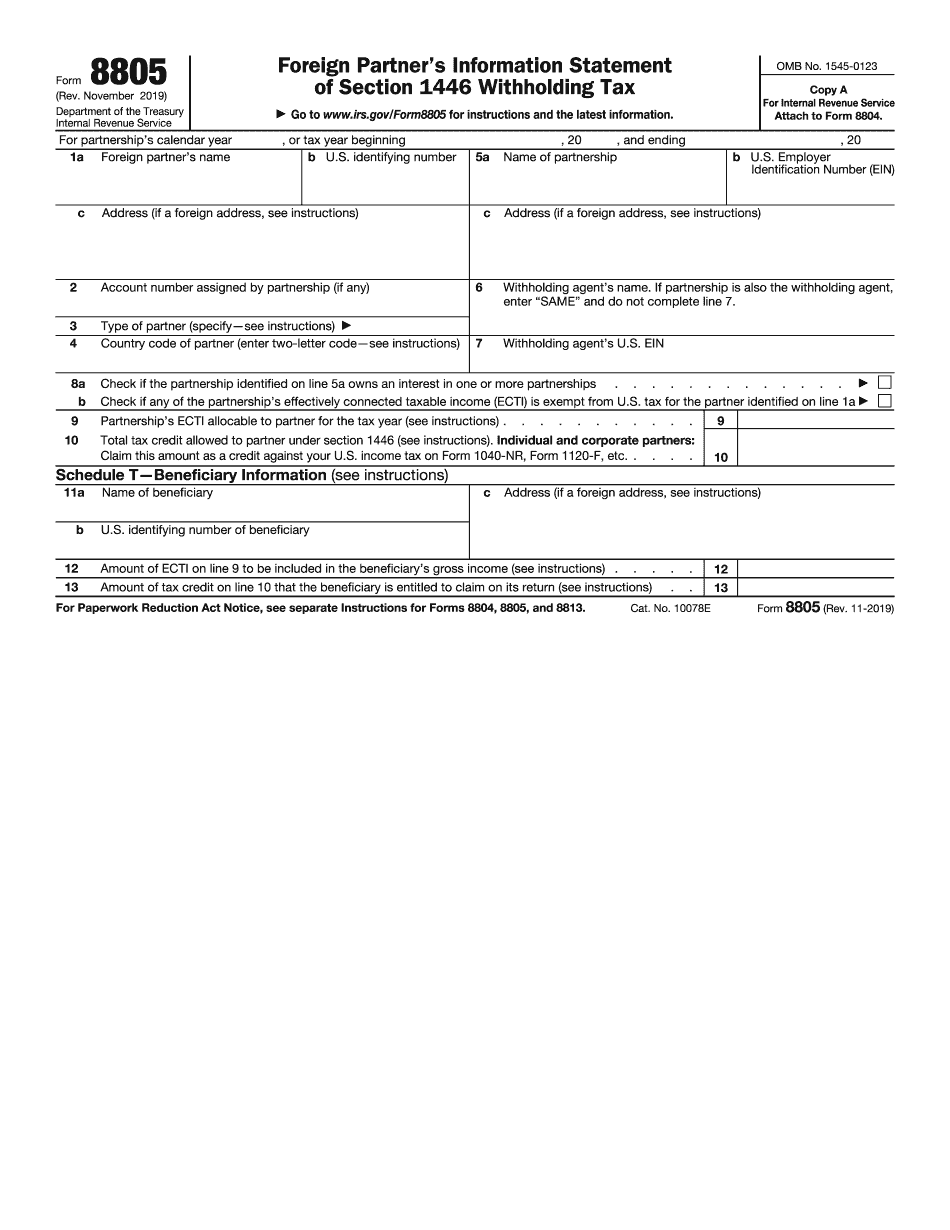

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8805, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8805 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8805 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8805 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Revenue procedure 92-66