You know, there's a lot of difference in ethics and cultural understandings between doing business in the US and China. But how difficult is it to find partners in China that you can trust? That's a difficult challenge. From the top big corporations down to the little ones, they've had both good and bad experiences. Usually, the partner you find over there has the same objective - making money. It's the middle management of the partner where the turnover is high because there are a lot of opportunities and they are looking for their own interests. That's where the risk lies. However, finding the right partner is possible if you do your homework. They can provide good quality service or they can also be thieves. This risk exists in any developing country, which is what China is. Therefore, you have to put in a lot of work no matter where you go.

Award-winning PDF software

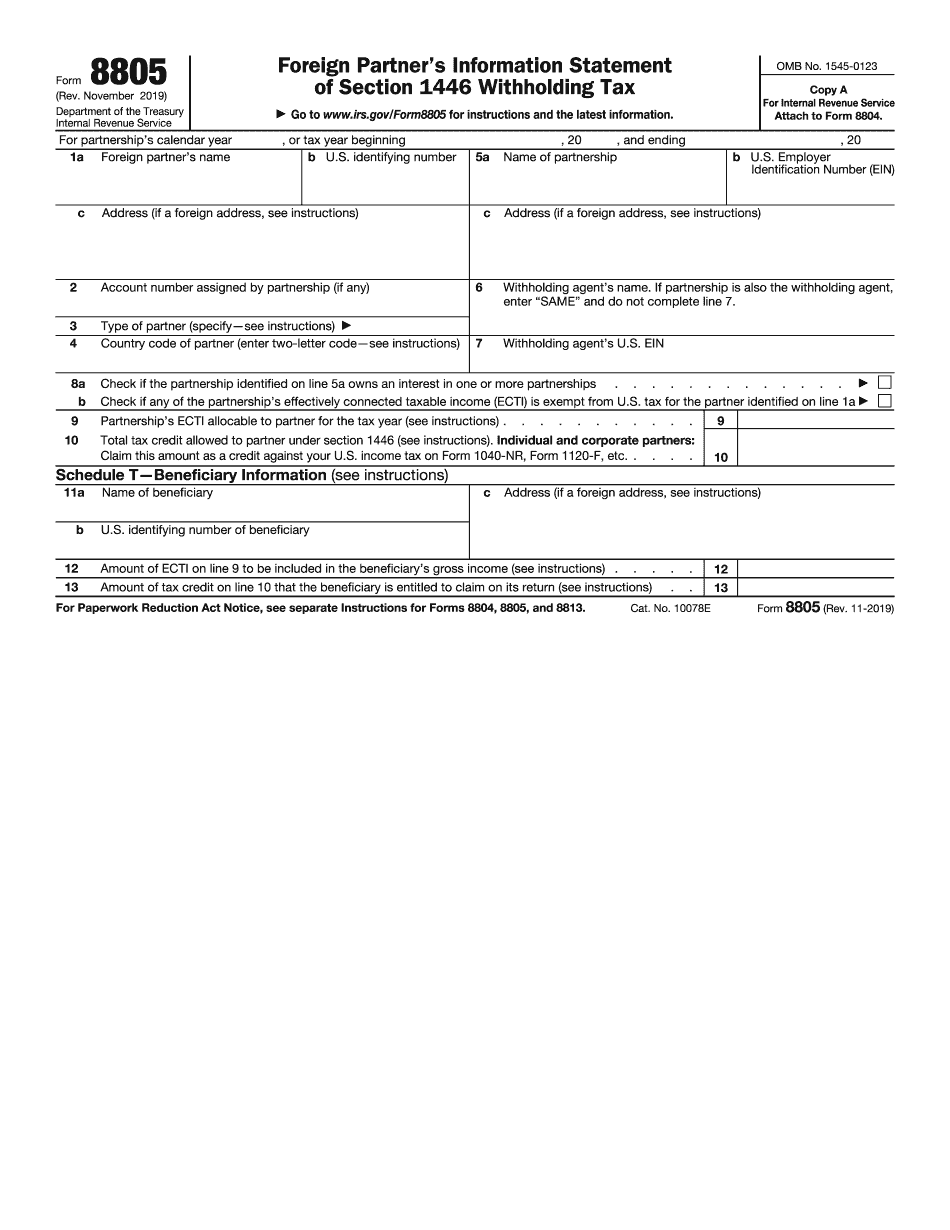

Going into business with a foreign partner Form: What You Should Know

S. Trade or business. As we wrote in February 2018: How to Fill Out IRS Form 8966 for Foreign Partners For those who do not qualify for Form 8950, the partnership will have to file a form known as “Form 8889.” Then, if the partnership meets the qualifications for Form 8889 and wants to file Form 8965, as noted in this link at the bottom of the page, it will also have to file a form known as an “Information Return.” The IRS has some additional information: The partner that has a foreign partner must have the proper Form 8849 for each particular partnership and Form 8849.10, Foreign Partnership Information Return, must be filed with each joint federal income tax return. It is also important to obtain the information required on the Form 8886, Foreign Partnership Information Return, which can be filed electronically. A number of forms and instructions for dealing with tax in foreign countries exist. The links listed below are to some of the most commonly used ones: Forms 8889 or 7089 are the form that must be filed with the Joint Federal Tax Return. You will need to file the 8889 on the company's tax return. You may also need to file it on the partnership's tax return. Form 8802 is the Form 8889 that must be filed by the partnership on the partnerships tax return. The instructions for Form 8802 can be found here. (This is a new addition to the IRS website. If you have previously filed Form 8802 with the IRS and you do not have a copy currently, do not panic. You can file copies of your 8802 on an alternative form by completing this form at the IRS website.) Other forms that may be necessary are Form 8819, Filing of Information Returns to Complete the Information Return Schedule (Form 8802), or Form 7082, Filing an Information Return (Form 1040). Forms 8821 or 8822 are the forms that must be filed by the partnership on the partnership tax return and should be filed in duplicate. A partner that has a foreign partner will also have to file Form 8822 on their own return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8805, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8805 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8805 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8805 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Going into business with a foreign partner