Award-winning PDF software

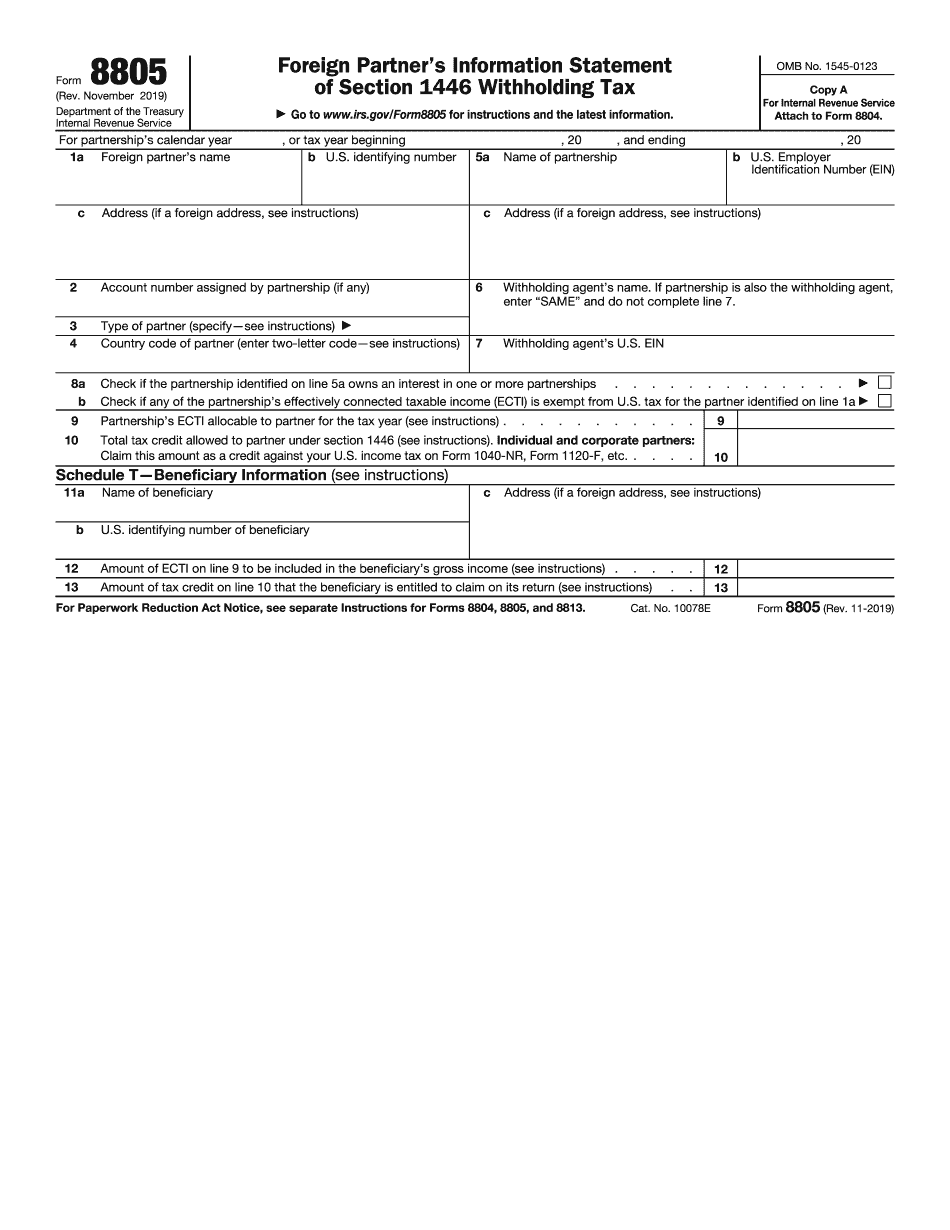

Caution: More Than One Type Of Us Federal Tax Withholding: What You Should Know

File a State return. Income tax withholding is only required of a partner or shareholder. File a Federal return. Income tax withholding is not required for the person filing as a partnership or for a partner or shareholder unless you are subject to the federal tax withholding provisions. In the case of an individual who is subject to the federal tax withholding provisions, there is no need for the partner or shareholder to withhold income tax unless they were a taxpayer within the meaning of IRC 7703 or their income includes income that was not taxed as ordinary interest. In this case, the partner or shareholder should file a Federal report, Form 8765, Schedule A, with their 1040 or 990 as follows. Form 8865 (Schedule A) Form 9326 (Schedule E) Income Tax Withholding A U.S. individual is required to withhold tax at the 30% rate for all income received in the U.S. The U.S. withholding rate applies to U.S. sources only, and not to sources outside the U.S. The Internal Revenue Service also has a separate, higher rate for certain “U.S. source nondeductible contributions” (e.g., IRA distributions, etc.), and certain “U.S. exempt interest income” (e.g., investment interest). Federal tax withholding is not required for foreign sources in excess of 250,000 (500,000 under the 2025 tax law and for 2013), as long as the foreign source must pay the amount withheld to the U.S. government. Foreign countries generally have their own withholding tax schedules. If you are a partner or shareholder in an S Corp and your foreign source income includes foreign income not subject to U.S. tax (either through income tax withholding or through the foreign tax credit), you may need to take additional action. The U.S. source income is taxed at the same rate as the U.S. person's domestic income (see below). All U.S. source income is subject to the 30% rate. The U.S. source income is not subject to an FAR (Foreign Bank and Financial Accounts) or FIN CEN (Financial Institutions Reform, Recovery, and Enforcement Act), or to an individual's foreign taxes on the income, in the case of an S Corp. This does not apply however if any of the following conditions are satisfied: The partnership or S Corp does not hold U.S.

Online remedies allow you to to prepare your doc management and enhance the efficiency of the workflow. Follow the fast tutorial in order to entire Caution: More than One Type of US Federal Tax Withholding, avoid glitches and furnish it in a well timed way:

How to accomplish a Caution: More than One Type of US Federal Tax Withholding internet:

- On the website using the sort, click Initiate Now and pass on the editor.

- Use the clues to complete the appropriate fields.

- Include your own material and contact details.

- Make absolutely sure that you enter appropriate information and facts and figures in proper fields.

- Carefully check the material belonging to the sort too as grammar and spelling.

- Refer to help you segment should you have any thoughts or handle our Guidance crew.

- Put an electronic signature on the Caution: More than One Type of US Federal Tax Withholding when using the guidance of Sign Software.

- Once the shape is completed, press Executed.

- Distribute the prepared variety by means of electronic mail or fax, print it out or preserve with your unit.

PDF editor allows you to definitely make improvements to your Caution: More than One Type of US Federal Tax Withholding from any world-wide-web related device, personalize it as reported by your preferences, indicator it electronically and distribute in numerous techniques.