Award-winning PDF software

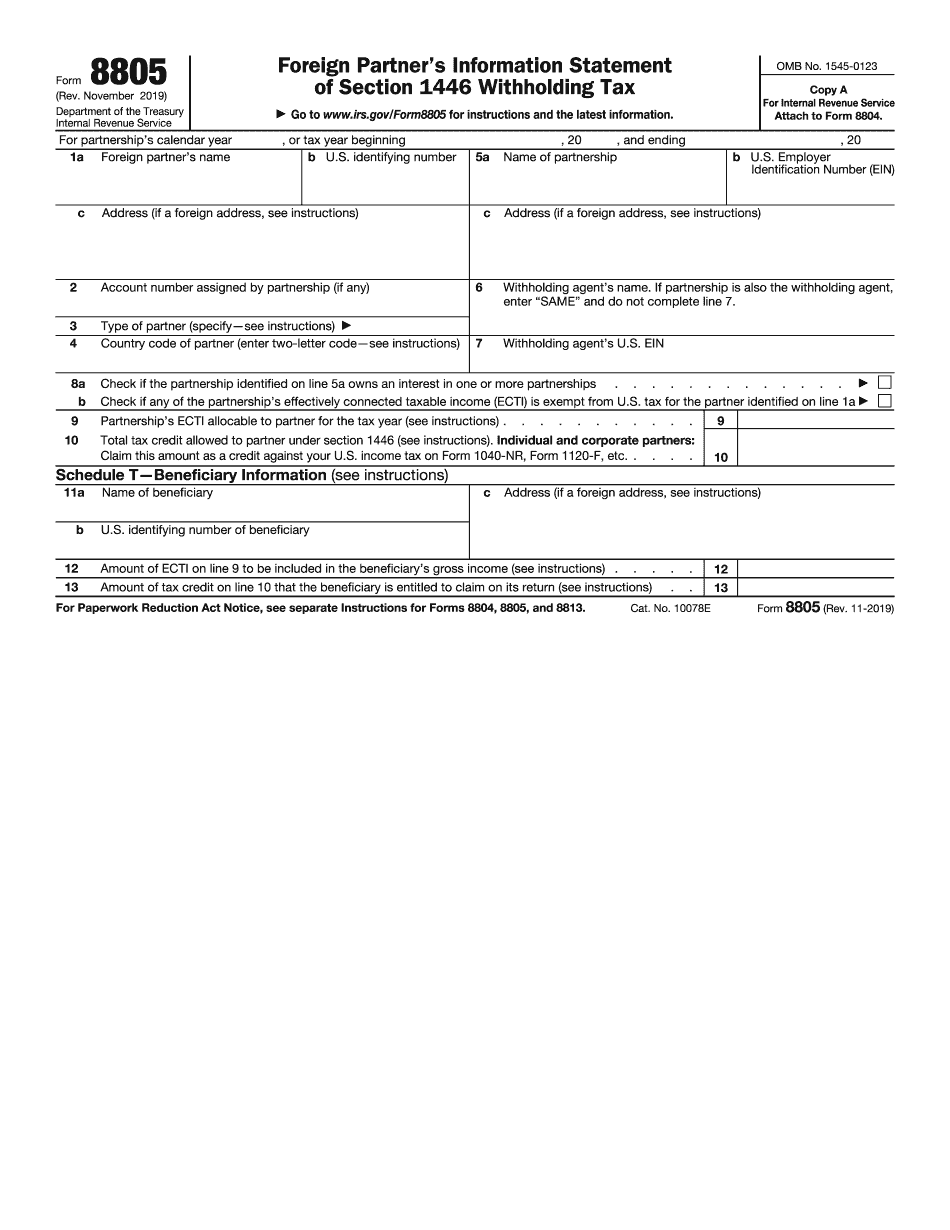

Partnership Withholding: All About Us Tax Forms 8804 & 8805: What You Should Know

For more information, How-to Use US Tax Forms 7609, 8848, 8086, & 8805 to Report Passive Income How-to Use IRS Form 8806 to Report Passive Income — U.S. Jun 30, 2025 — Form 8806 is an annual summary statement of any Forms 8808 and 8809 that were sent to foreign partners from a foreign partnership (or trust). The partnership report on Form 8802 must be Form 8806 is an annual summary statement of any Form 8808 and 8809 that were sent to foreign partners from a foreign partnership (or trust). The partnership report on Form 8802 must be Partnership Withholding: All About Form 8806 — IRS Sep 9, 2025 — Use Form 8806 to report U.S. partnership income tax attributable to active, tax avoidance partnership investments (such as partnerships that hold stock for trading in other countries). How-to Use IRS Forms 8848, 8086, & 8804 To Report Passive Income — US Sep 31, 2025 — The partnership will report passive income for its U.S. investments through Form 8848 or Form 8086. These forms must be filed jointly. Forms 8848, 8086 & 8804 Active Income Report Sep 21, 2025 — Use the table to get current information about any Forms 8848, 8808, and 8809 that were given to foreign partners Form 8848, Foreign Partnership Withholding Forms 8808 & 8809 Passive Income Report Oct 1, 2025 — The partnership will report passive foreign investment income on Form 8808 and 8809 based on the partnership's U.S. investments through how-to Calculate Passive Foreign Investment Income How-to Use IRS Schedule D, Passive Foreign Investment Income Sep 10, 2025 — The partnership will report passive U.S. income on Form 8860 as specified in the partner's Form 8802, Form 8809, or Form 8806, and on Schedule D (Pension and IRA) by completing how-to Calculate Passive U.S. Income How-to Use IRS Forms 2848 & 8880, U.S.

Online options aid you to organize your doc administration and raise the efficiency of your respective workflow. Stick to the short information so that you can entire Partnership Withholding: All About US Tax Forms 8804 & 8805, keep away from problems and furnish it within a well timed fashion:

How to complete a Partnership Withholding: All About US Tax Forms 8804 & 8805 on line:

- On the web site while using the variety, click on Start out Now and pass to your editor.

- Use the clues to complete the pertinent fields.

- Include your personal knowledge and call details.

- Make confident you enter appropriate information and facts and numbers in acceptable fields.

- Carefully check the subject material with the type too as grammar and spelling.

- Refer to aid part if you have any questions or handle our Support group.

- Put an digital signature in your Partnership Withholding: All About US Tax Forms 8804 & 8805 with all the guidance of Indication Instrument.

- Once the shape is completed, press Finished.

- Distribute the prepared variety by using e-mail or fax, print it out or preserve on your machine.

PDF editor allows for you to make changes for your Partnership Withholding: All About US Tax Forms 8804 & 8805 from any world wide web related unit, customize it as per your requirements, signal it electronically and distribute in several ways.