Award-winning PDF software

Us tax forms 8804 & 8805 foreign partner's withholding

All of these payments will be excluded from the gross income under Section 1061, because the income of each partner is the same. The income of a partner would be calculated as follows: (C + B)/2 = gross income. The tax-free income amount on partnership returns can be adjusted for any adjustments. This method is generally followed if the taxpayer makes the payment in a trade or business and reports the payments on a trade or business return. If the taxpayer elects not to make the payments on a tax-free basis in a return filed for income tax purposes or reports the payments on their own tax returns, the partnership may elect to report and pay the amount on Form 990-T, Application for Certificate of Correction of Overpayment, and File Form 8809, Application for Certificate of Exclusion, if the partnership makes the payment on or before the due date,.

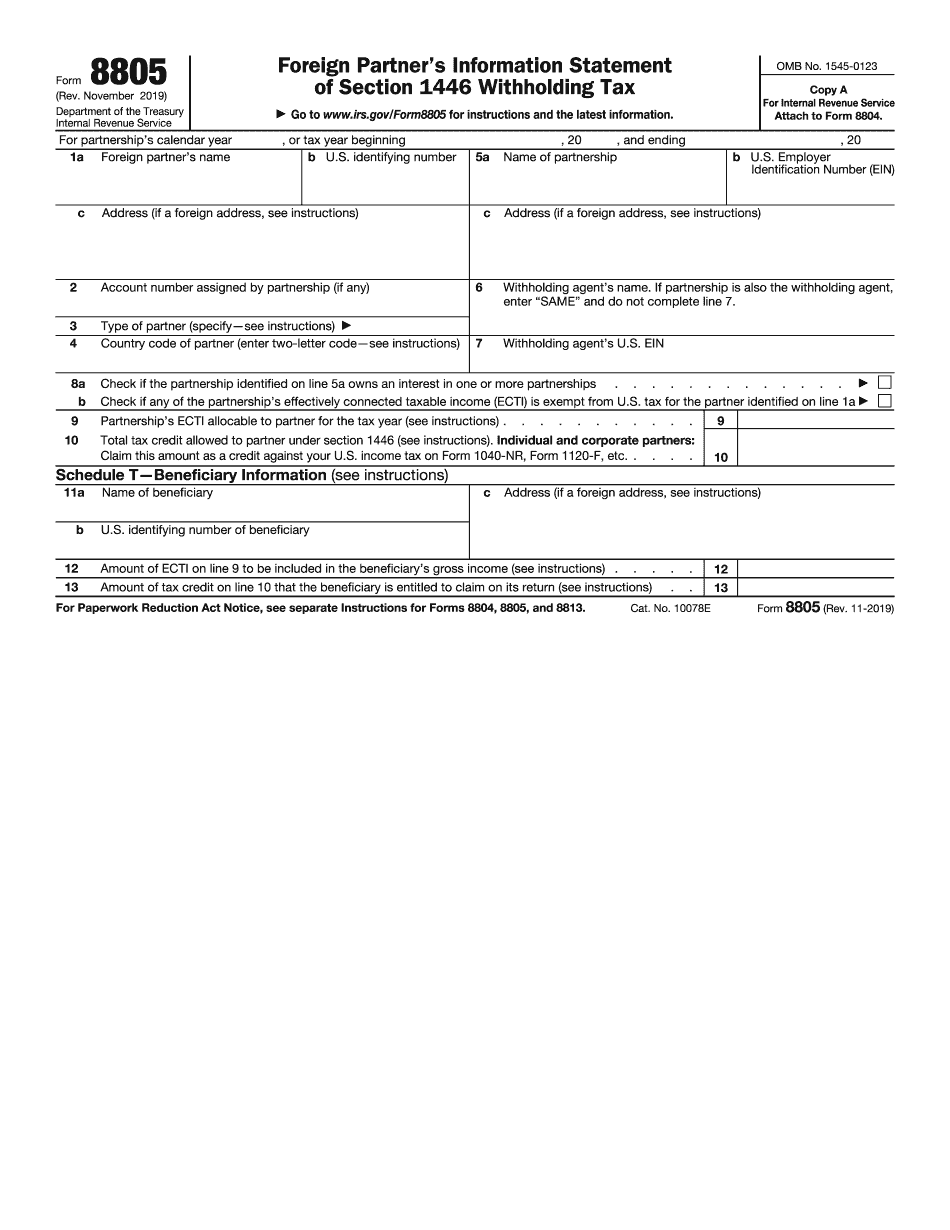

forms 8805 and 8804 – a guide for expats - bright!tax

Income Tax – It is common for a Form 8805 to be filed on behalf of a foreign partner if there is a US-registered Partnership in their foreign . The partnership is required to file Form 8805 for the foreign partnership or an individual in their foreign partner's . The foreign partner is not required to file an IRS Form 8805 or a US-registered Partnership is not required to file Form 8809 if there is no US-registered Partnership. The US-registered partnership shall be identified in their partnership documents by name and address of their principal place of business, a “foreign partnership”. Form 8805 for an foreign person includes a Form 8802, a Form 8803, Form 8804, Form 8805, or Form 8809. Form 8802 shall be filed by a foreign person or for a foreign partnership who is an individual or foreign partnership who are US based. Form 8803 shall be filed by a foreign.

Partnership withholding: all about us tax forms 8804

Foreign partners of the LLC. Form 8806 is used to allocate the amount of PCI (from the foreign partner), on Form 2848, Individual Income Tax Return. The partner may then claim an itemized deduction for those amounts, in the tax year in which the amounts were allocated. In addition, an amount for any amount allocated to a disqualified partnership is includible in income, even though the corporation is no longer an active foreign partnership. However, see §(i)(3). (iii) The other partners in the LLC are not eligible to request the allocation of their PCI. (8) Section 751(g)(2)(B) of the Code (discussed supra, section (b)) requires that a domestic partnership that meets the qualification requirements of Form 8806, must allocate all amounts attributable to any qualifying partnership to the qualifying partnership on Form 2848, Individual Income Tax Return. A partner's allocation of an amount under this section may or may not be.

Staff view: form 8805, foreign partners's information statement

Tax & General Fund, C-2(B). January 1, 2006. (2)-02 Criminal history records. No person shall fail or refuse to have the criminal history records of that person's spouse and children in his or her possession. For the purpose of this section, the term ``criminal justice agency'' includes, but is not limited to, the juvenile court or jail. (1)(C)(2) Criminal history records. The criminal history records of a person's spouse or children shall be provided to a State Department of Corrections or Juvenile Justice in the case in which the State Department of Corrections or Juvenile Justice requests the crime record information. A person who does not provide the information may be charged with a violation of this section. This law was approved November 20, 2010. (2)-02(6) Prohibited grounds for denial, suspension, or revocation of a foreign partner's tax exemption; procedures. No foreign partner of a nonprofit organization shall be denied the tax exemption afforded through section 501(c)(3).

How do i activate form 8805, foreign partner's information

In this form, under Part 4, locate your Form 8802.) Sign, date and file it. Once you've completed and signed Form 8802 and the appropriate fee, take Form 8802 to your nearest IRS Office. 4. For additional assistance, please refer to Questions and Answers for Forms 8802. Additional information and forms are available on the Instructions for Form 8802.