Award-winning PDF software

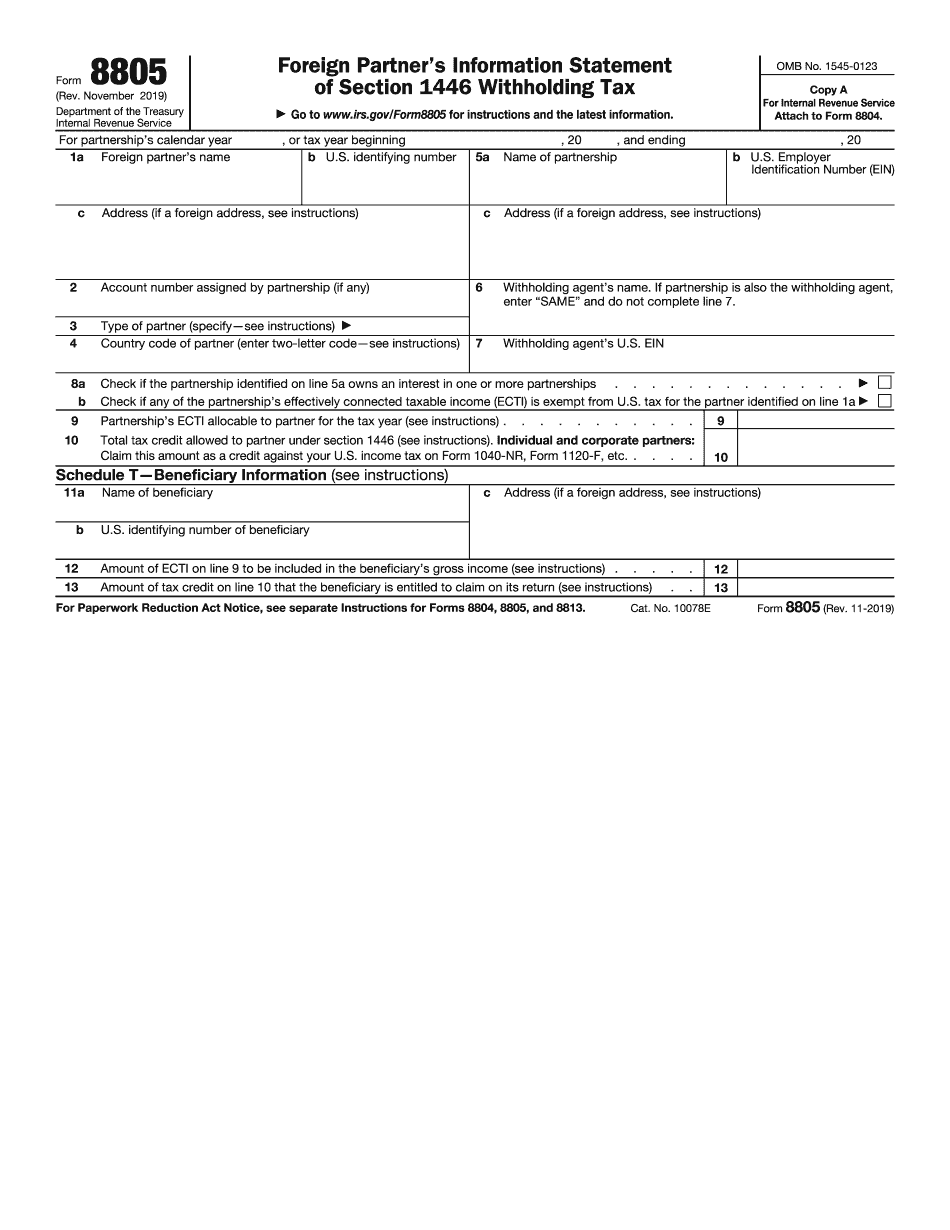

Atlanta Georgia online Form 8805: What You Should Know

Fiduciaries' income from foreign source and Form 8813 to deduct foreign tax on section 1446 income (Form 8809). This page has been accessed 15,741 times. Visit our other Georgia tax information pages: Georgia Sales Tax, Georgia Sales Tax FAQs and Income Tax Returns for Individuals. Tax-Rates.com is a USA TODAY content partner offering tax advice. Its content is produced independently of USA TODAY. New! Tennessee's Business Tax Guide Tennessee business owners must file Tennessee state income tax returns and pay sales tax if required to do so by law. Find out how to file, pay and file late. New! Tennessee's Tax Guide Tennessee is a state with a unique combination of a business friendly business climate, a low state income tax rate, a high-deductible health plan and excellent business tax incentives. With all that to offer, and the possibility of some of the best tax planning opportunities in the United States, it's no wonder Tennessee business owners choose Tennessee! You can find a comprehensive Tennessee business tax guide on our home page. If you are in Tennessee, you are entitled to the same tax incentives as everyone else. The Tennessee Economic Development Partnership's (TED) state government incentive program is one of the most generous tax incentives in the nation. For each 1 million a business invests, it receives 2 million in tax breaks. New! Tennessee Tax Credits You may get a credit for qualified Tennessee property or plant purchases. The list of qualifying property is updated every month by the TED. If you've purchased property from TED in the past, you have an advantage, because the first 8,000 you spent on your property gets a credit, as long as you buy at least five Tennessee qualified properties or up to 300, such as new construction. If you are filing for a 2025 TES tax credit, you may have to pay sales tax if you are not eligible for a deduction on your federal tax return. Please consult with the Tennessee Department of Revenue for specific tax credits for a particular purchase. To check whether a property is qualified or not, you may contact: Tennessee Department of Revenue, Business and Occupation Services, PO Box 431, Nashville, TN 37, New! Tennessee Sales Tax Tennessee state sales tax is 1.5% as of December 2017. As part of Tennessee's TES program, sales tax is not included in the state tax on business.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Atlanta Georgia online Form 8805, keep away from glitches and furnish it inside a timely method:

How to complete a Atlanta Georgia online Form 8805?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Atlanta Georgia online Form 8805 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Atlanta Georgia online Form 8805 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.