Award-winning PDF software

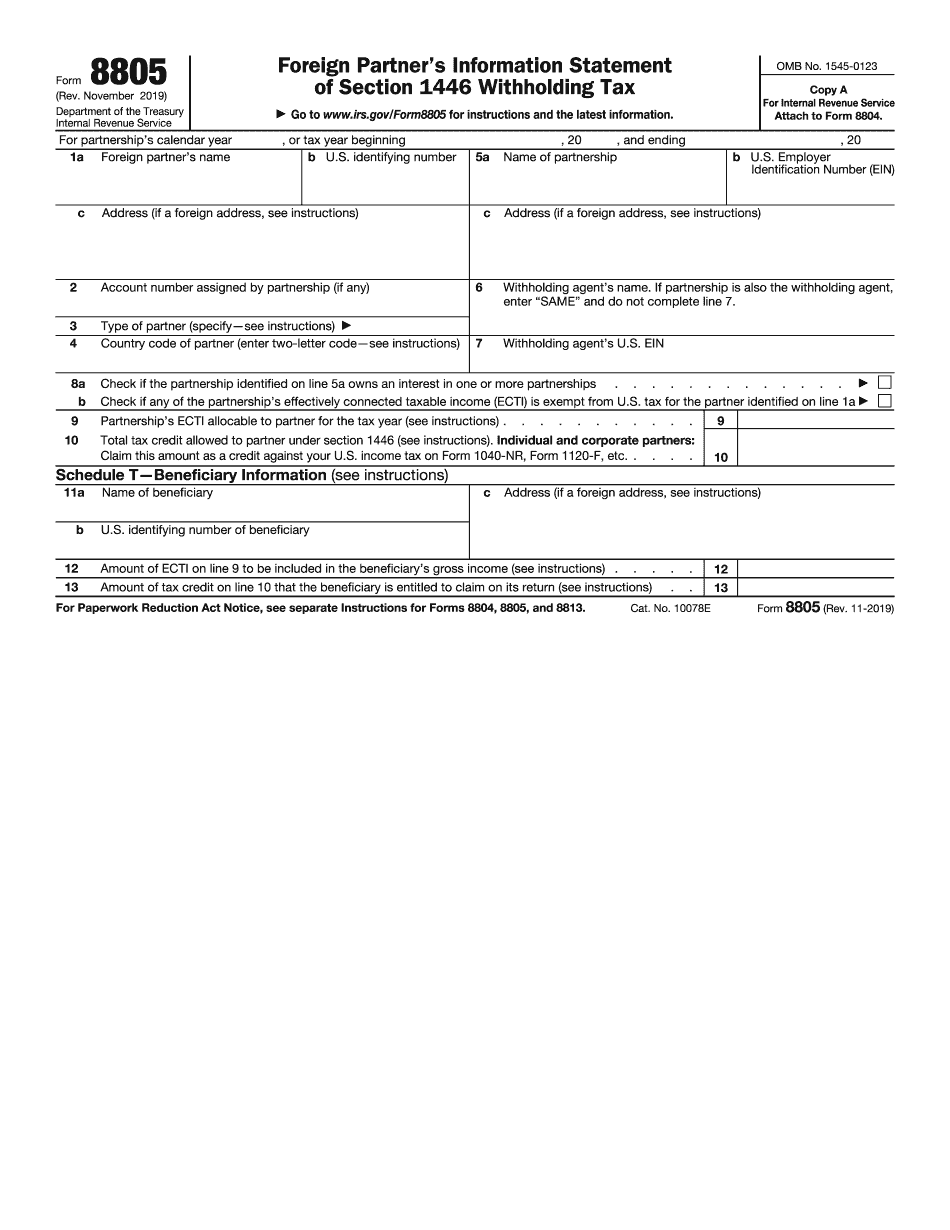

Printable Form 8805 Jersey City New Jersey: What You Should Know

Questions about New Jersey Individual Retirement Fiduciaries This resource is intended to assist individuals considering filing as an investment advisor with the New Jersey Corporation Commission, New Jersey Division of Investment and the New Jersey State Board of Risk Management in their decision-making about establishing or managing an Individual Retirement Benefits Plan (IRA) through the New Jersey State Investment Council (New Jersey Governor's Office of Investment Policy) in New Jersey. Answers to questions for New Jersey Individual Retirement Fiduciaries on the New Jersey General Taxes and Trusts (NJG IT), New Jersey State Retirement Board (NJ SRB) and New Jersey Public Employees' Retirement System (NJ POST) websites are included. Tax Filing Requirements for New Jersey Investors — New Jersey Investment Council (NJ ITC) This section of the brochure is meant to help New Jersey tax- New Jersey Corporate Tax Filing Requirements The New Jersey State Investment Council (NJ ITC) has recently published the New Jersey Corporate Tax Filing Requirements. It contains information on all state corporate income tax filing requirements, plus guidance on certain information reporting and tax withholding obligations when an individual is enrolled as a New Jersey corporate investment advisor. Form 8500: Foreign Partnership Form 8802. Form 8884: Foreign Partnership Form 8887: Foreign Partnership Form 8885(a): Foreign Partnership Form 8885(b): Foreign Partnership Form 8888: Foreign Corporation. Form 8888a. For general form 9086a. Form 751: Domestic Partnership/General Partnerships Form 4856: Foreign Partnership/General Partnerships The State of New Jersey Department Agency on Aging (DATA) is responsible for collecting information and submitting forms and guidance to the State Capital Planning Board (CBP), the New Jersey Department of the Treasury, and any other state agency or public bodies that are involved in the Capital Plan. These forms, in many cases, may be mailed to: The New Jersey Capital Planning Board 1180 Main Street, Room 4-200 East Rutherford, NJ 07 or in some cases, may be downloaded. Important dates for filing: New Jersey Corporate Income Tax Forms Information about Federal Corporations Form 904: U.S. Limited Partnership. Form 906: U.S. Limited Partnership. Form 9084: Foreign Limited Partnership. Form 9088: Foreign Limited Partnership.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 8805 Jersey City New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 8805 Jersey City New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 8805 Jersey City New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 8805 Jersey City New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.