Award-winning PDF software

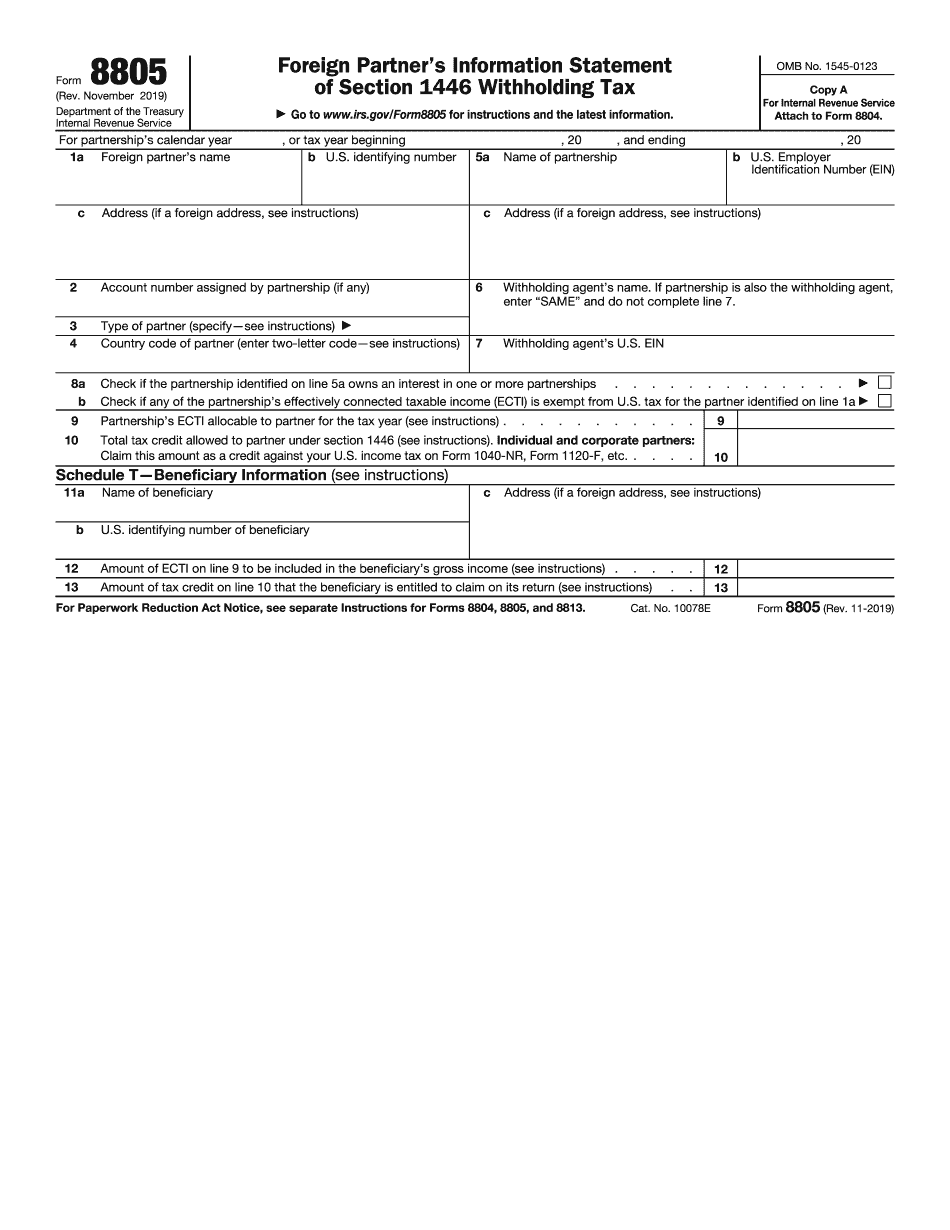

Form 8805 online Philadelphia Pennsylvania: What You Should Know

What are the requirements for making a U.S. financial instrument? What is a Schedule K-1, W-2 and Form 8805? A. You may invest in a U.S. financial instrument (financial product or security) (FDS) only if the instrument meets the requirements of U.S. regulations (the Internal Revenue Code, or the Code). These regulations govern financial products that are traded in the U.S. (the territory in which the issuing securities are traded) and that are listed on US exchanges (the exchange where the instruments are traded). Instruments have been described as stocks, bonds, mutual funds but not other securities such as options, certificates of deposit, or other investment products. The most common regulatory requirement is that an instrument must be available through the regular financial markets. Examples are securities trading on the stock exchanges; fixed income futures contracts and options. Some issuers choose to list their instruments in the over-the-counter exchange and provide investors with access to the securities through U.S. financial markets (over-the-counter markets, OTC markets, or futures markets). If the instrument is listed on a U.S. exchange, it must have an approved prospectus or an alternative financial information (AFI) document. If you are a US FMC participant, the instrument must comply with the rules of your jurisdiction governing market structure and access to the instruments through OTC markets. The instrument will typically be eligible for credit by the U.S. agency that issued the instrument. An approved prospectus (also known as a prospectus amendment, a Form 10-Q or an SEC Form 7A) filed by a U.S. issuer with the U.S. Securities and Exchange Commission (SEC) provides that the instrument is eligible for credit in the United States. This form establishes a date of first sale and also requires that each holder must own a minimum number of shares of the issuer's common stock (which is the price of the instrument) or be related to the issuer's officers or directors. Forms may be required from companies registered under U.S. securities laws (the “United States”). An authorized prospectus filed by a corporation or partnership that will be a U.S. holder should be attached to the instrument; a “US” form is considered to be a form that is subject to registration by the SEC.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8805 online Philadelphia Pennsylvania, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8805 online Philadelphia Pennsylvania?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8805 online Philadelphia Pennsylvania aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8805 online Philadelphia Pennsylvania from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.