Do non-US people pay tax on K-1 income?

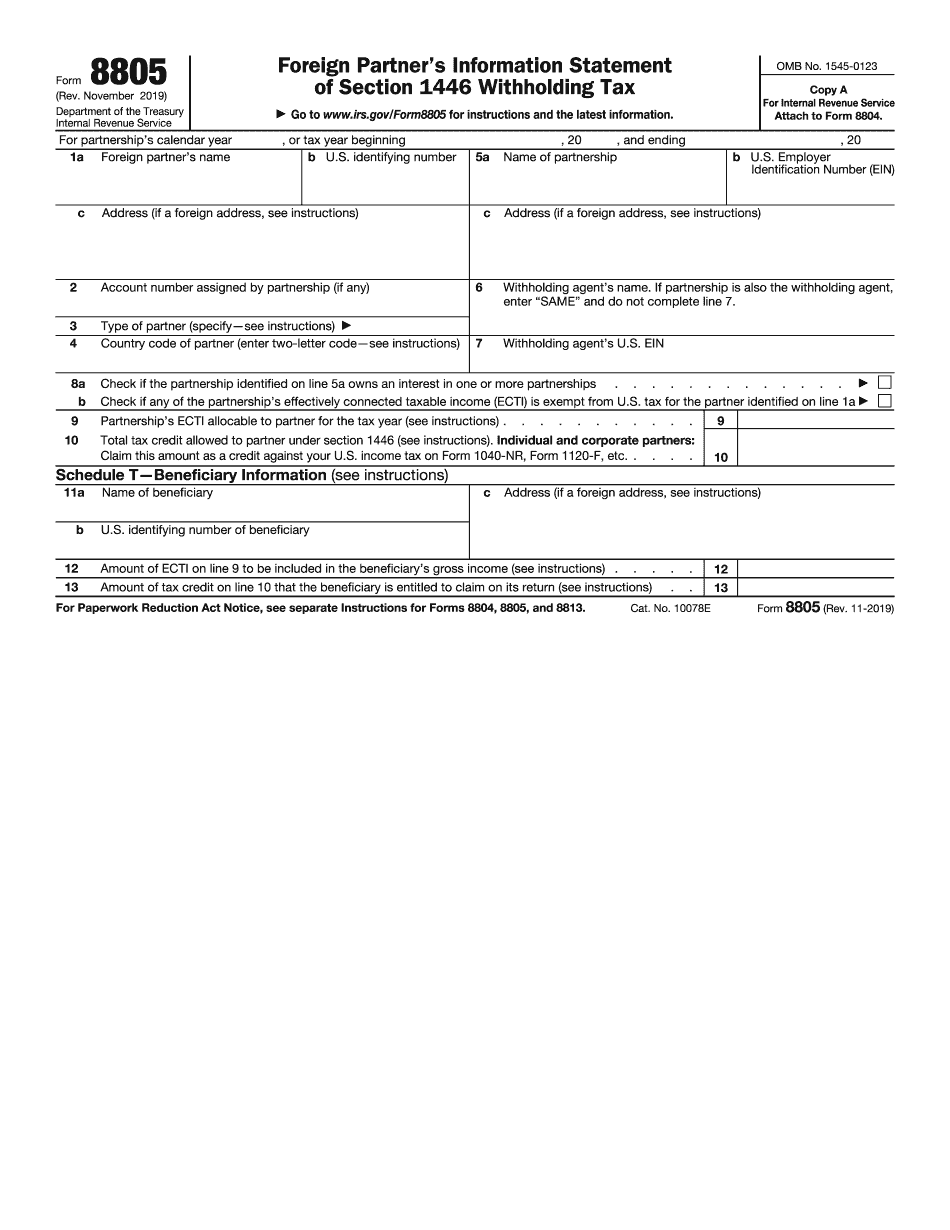

A2A. They do, although for many non-US persons their tax liability may already have been covered by partnership-level withholding. Non-US persons that are partners in a US partnership are subject to tax on their distributive share of the partnerships taxable income that is effectively connected with the conduct of the partnerships US trade or business (ECTI). The US partnership is required to withhold and pay taxes on a foreign partners ECTI under 26 U.S. Code 1446 - Withholding of tax on foreign partners share of effectively connected income. A foreign partners ECTI, along with the partners tax credit for the taxes paid by the partnership on that ECTI under Section 1446, are reported to both the IRS and to the partner on Form 8805. The partnership will take into account any income for which the foreign partner is exempt from taxation due to tax treaties and the like, plus any documentation that the partner has provided to the partnership - the partnership should request, and the partner should supply, an appropriate Form W-8. That said, the partnership isnt necessarily going to know all of the benefits that are available to the foreign partner, and if the foreign partner determines that the partnership withheld too much, the foreign partner will need to file Form 1040-NR to receive a refund of the extra withholding.